The seasonal low is here?

Key Points

Gold

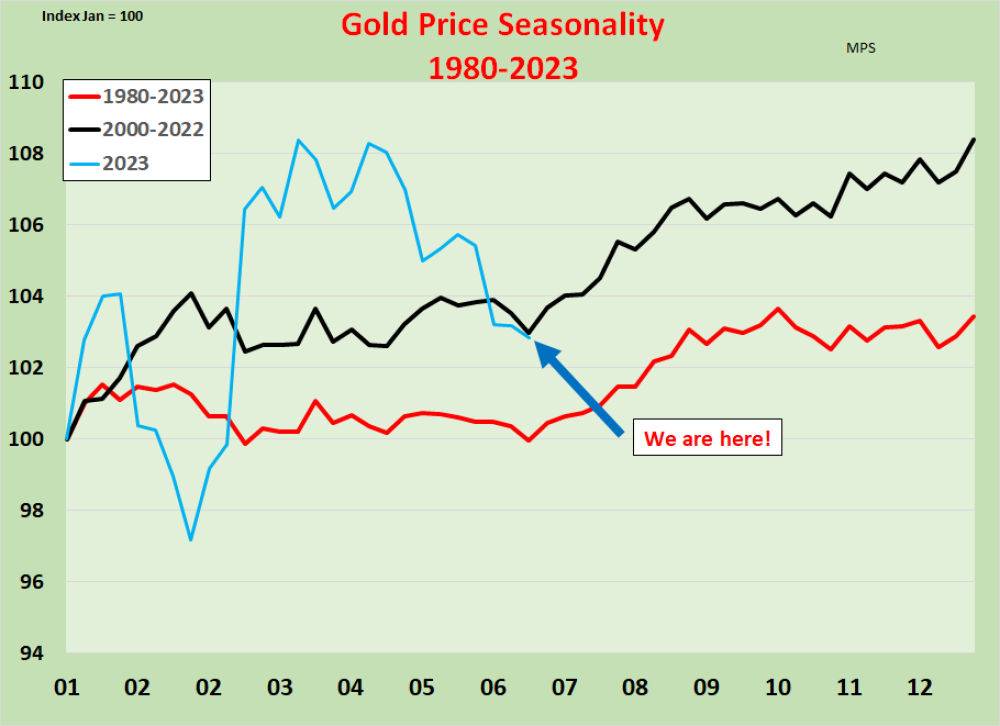

- Gold fitting into seasonal lows

- Wedge is tightening

- Volatility remaining

Gold Stocks

- Backtesting wedge upside breakout

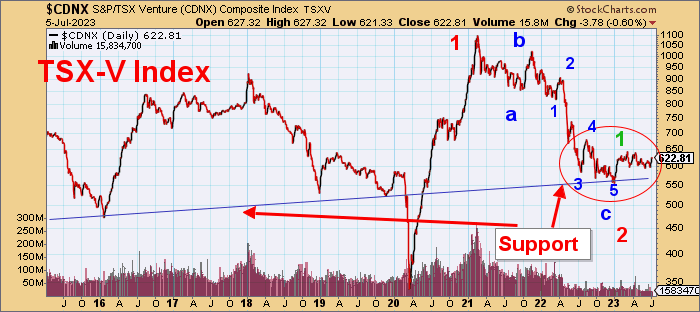

- TSX-V shows some life

ASX Gold stocks

- XGD downtrend broken

- Backtesting wedge upside breakout

Bonds

- Brinkmanship from market players

- Breaking up or breaking down?

- Yields?

- Bond prices?

- Reversals can come very quickly from these technical positions

US$

- Still strong and heading higher

Gold

Volatility continues in gold into this seasonal low period.

More very constructive bottoming action with this wedge. Test of the downtrend, and last Thursday might have been a reversal.

If this is, in fact, a C Wave completing Wave 2, then Wave 3 is directly ahead. Maybe a sharp rise is in store for gold.

A bit more work to be done here but a breakthrough US$1940 basis the futures would be technically very important.

The power build-up here in this narrow trading range should be enough to send gold to a new high.

This still looks robust and ready to break much higher.

Gold stocks

As noted, this has been an unusual correction with a second series of five waves down.

It bottomed nicely on the downtrend and has broken quite powerfully through the wedge.

It is now backtesting.

Not quite the same pattern here on ASX, but it is a break-out and backtest.

Keep watching this Canadian Junior market.

It seems to be about to move higher into its own Wave 3 as well.

Bonds

Bonds are important in the marketplace, and their price and yield directions could affect gold.

But how is simply not clear.

It doesn't really matter, but it has certainly been an interesting time watching this battle pan out!

- Brinkmanship continues

- Evidence could be pointing to resumption in bear market for bonds as yields rise

- Or not

- Could be all just overbought

- But note that trend reversals can come quickly from these technical positions

10-Year bond

- Yields about to break higher?

- Or just overbought and peaking?

30 Year Bond

- Yields about to break higher?

- Or just overbought and peaking

TLT 20-Year T Bond ETF

- Backtesting and breaking up

- or breaking down?

- Oversold

- Reversals from technical positions like this can be very sharp

US$

Still rising again.

- Because U.S. assets are cheap?

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.